| Channel | Publish Date | Thumbnail & View Count | Actions |

|---|---|---|---|

| | Publish Date not found |  0 Views |

Take our Finance & Valuation Course: https://www.careerprinciples.com/courses/finance-valuation-course

DOWNLOAD Free Excel file for this video: https://view.flodesk.com/pages/644bc2d12cc6cca29ac045e0

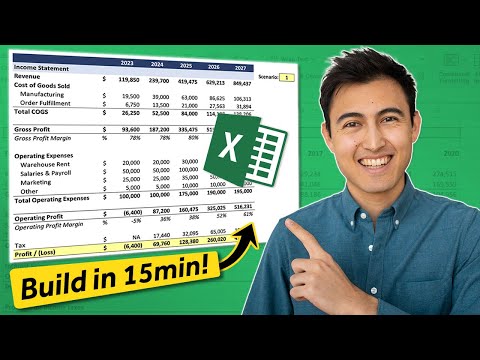

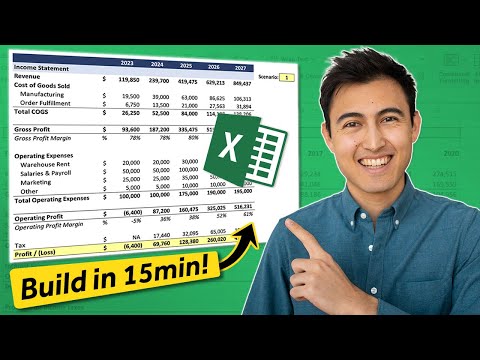

In this video we’ll build a financial model in just 4 steps. First, we’ll make a revenue forecast using the number of orders and the order value. Then, we’ll work on forecasting the variable expenses (COGS) and the fixed expenses (SG&A). Third, we’ll build the income statement and the profit margins based on the assumptions. Finally, we’ll make the model dynamic by creating scenario analysis using the choose formula on Excel.

LEARN:

The Complete Finance & Valuation Course: https://www.careerprinciples.com/courses/finance-valuation-course

Excel for Business & Finance Course: https://www.careerprinciples.com/courses/excel-for-business-finance

The Data Analyst Program: https://www.careerprinciples.com/career-track/the-data-analyst-program

All our courses: https://www.careerprinciples.com/all-courses

SOCIALS:

My Company YouTube Channel: https://www.youtube.com/@careerprinciples

Instagram – https://www.instagram.com/careerprinciples/?hl=en

TikTok – https://www.tiktok.com/@career_principles

LinkedIn – https://www.linkedin.com/company/careerprinciples/

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Chapters:

0:00 - Intro

0:33 – Revenue Assumptions

2:37 – Fixed & Variable Cost Assumptions

6:03 – Building the Income Statement Forecast

10:28 – Making it Dynamic with Scenario Analysis

Please take the opportunity to connect and share this video with your friends and family if you find it useful.